1. What is the demerger about?

The demerger involves transferring ITC Limited's Hotels Business to a newly formed company, ITC Hotels Limited (ITCHL). Effective January 1, 2025, this separation allows ITC to focus on its core businesses while enabling ITCHL to pursue independent growth in the hospitality sector?

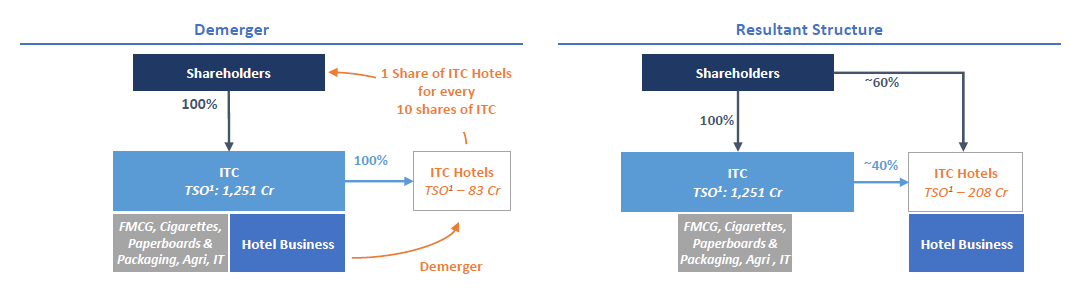

TSO: Total shares outstanding

Existing number of shares of ITC are 1251 Cr

New shares to be issued of ITC hotels, 1 share for every 10 shares of ITC, resulting in 125 Cr shares

Shareholders direct ownership in ITC hotels is 60%

Therefore, total shares of ITC hotels = 125 Cr/60% = 208 Cr shares

And resulting shares of ITC hotels with ITC is 40% i.e. 83 Cr shares

2. What does the shareholding structure look like post-demerger?

- Existing ITC shareholders will hold 100% of ITCHL:

- 60% directly through ITCHL shares.

- 40% indirectly through ITC’s retained stake in ITCHL.

- Share allocation: 1 share of ITC Hotels for every 10 shares held in ITC.

3. What assets and liabilities are being transferred?

- Transferred to ITCHL:

- Hospitality entities (e.g., Fortune Park Hotels, Bay Islands Hotels, Srinivasa Resorts).

- Operating assets, trademarks, employees, and liabilities of the Hotels Business.

Operating Service Agreement to be executed between ITC and ITC Hotels to operate & manage ITC Grand Central, Mumbai

Cash reserves of Rs. 1,500 crore to support growth and contingency needs.

- Retained by ITC:

- Certain financial and non-operational investments, including EIH Limited and Logix Developers Pvt. Ltd.?

4. What is the timeline for listing ITC Hotels?

- Record Date for determining shareholder eligibility: January 6, 2025.

- ITC Hotels shares will be listed within 60 days of receiving the NCLT order (expected by February 2025).

5. What is the strategic rationale for the demerger?

The demerger aligns ITC Hotels with its strategic pillars:

- Focus on capital productivity and asset-right growth.

- Enhance brand equity and customer engagement.

- Pursue selective inorganic opportunities with a zero-debt balance sheet.

- Target growth in managed hotels, with a plan to achieve a two-thirds managed portfolio share by FY30.

6. What are the growth prospects for ITC Hotels?

- Pipeline of 45 new managed hotels (~4,000 keys) to be added.

- 300+ rooms being planned under Owned Hotels, expansion projects at Bhubaneswar and a greenfield project in Puri.

- Targeting 200+ hotels with 18,000+ keys over five years?.

This demerger positions ITC Hotels as a focused entity, unlocking shareholder value while fostering long-term growth in the hospitality space.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: